Huge movement on Australia 200 Index, did you miss it?

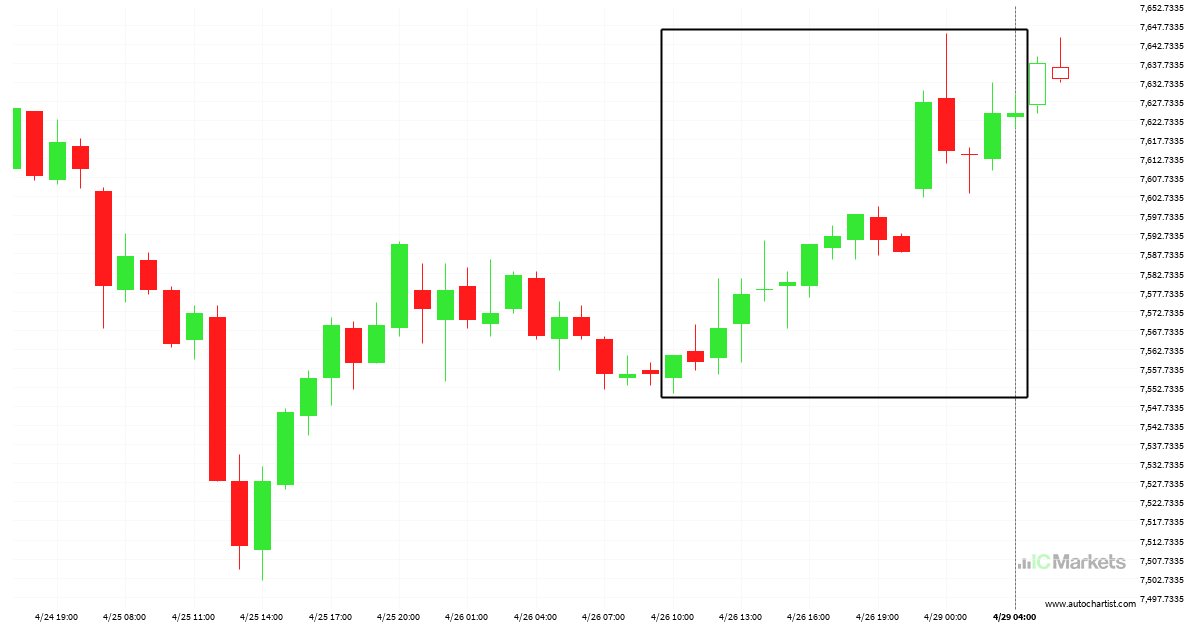

Australia 200 Index has moved higher by 0.84% from 7561.2 to 7624.56 in the last 3 days.

Australia 200 Index – Continuation Chart Pattern – Channel Up

Australia 200 Index was identified at around 7590.09 having recently rebounded of the support on the 4 hour data interval. Ultimately, the price action of the stock has formed a Channel Up pattern. This squeeze may increases the chances of a strong breakout. The projected movement will potentially take the price to around the 7756.3847 […]

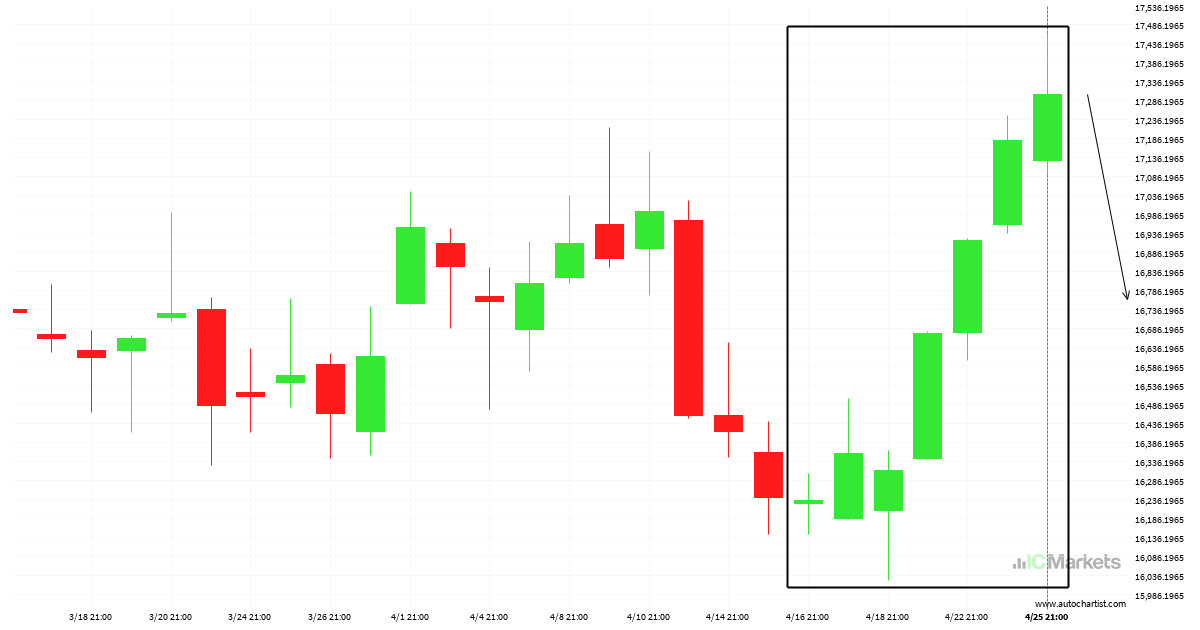

Hong Kong 50 Index – Large movement, a rare opportunity

Due to the rate of consecutive bullish candles on Hong Kong 50 Index Daily chart we could be in for a price correction. If not, this trend could be a sign of things to come

Australia 200 Index approaching support of a Falling Wedge

Australia 200 Index is approaching the support line of a Falling Wedge. It has touched this line numerous times in the last 3 days. If it tests this line again, it should do so in the next 11 hours.

Australia 200 Index breakout through resistance

Australia 200 Index has breached the resistance line at 7634.2998. It may continue the bullish trend towards 7698.5942, or, it may prove to be yet another test of this level.

Hong Kong 50 Index – Continuation Chart Pattern – Falling Wedge

Emerging Falling Wedge pattern in its final wave was identified on the Hong Kong 50 Index 4 hour chart. After a strong bearish run, we find Hong Kong 50 Index heading towards the upper triangle line with a possible resistance at 15930.0225. If the support shows to hold, the Falling Wedge pattern suggests a rebound […]

Resistance line breached by Australia 200 Index

Australia 200 Index has broken through the resistance line which it has tested twice in the past. We have seen it retrace from this line before, so one should wait for confirmation of the breakout before trading. If this new trend persists, a target level of around 7718.5875 may materialize within the next 14 hours.

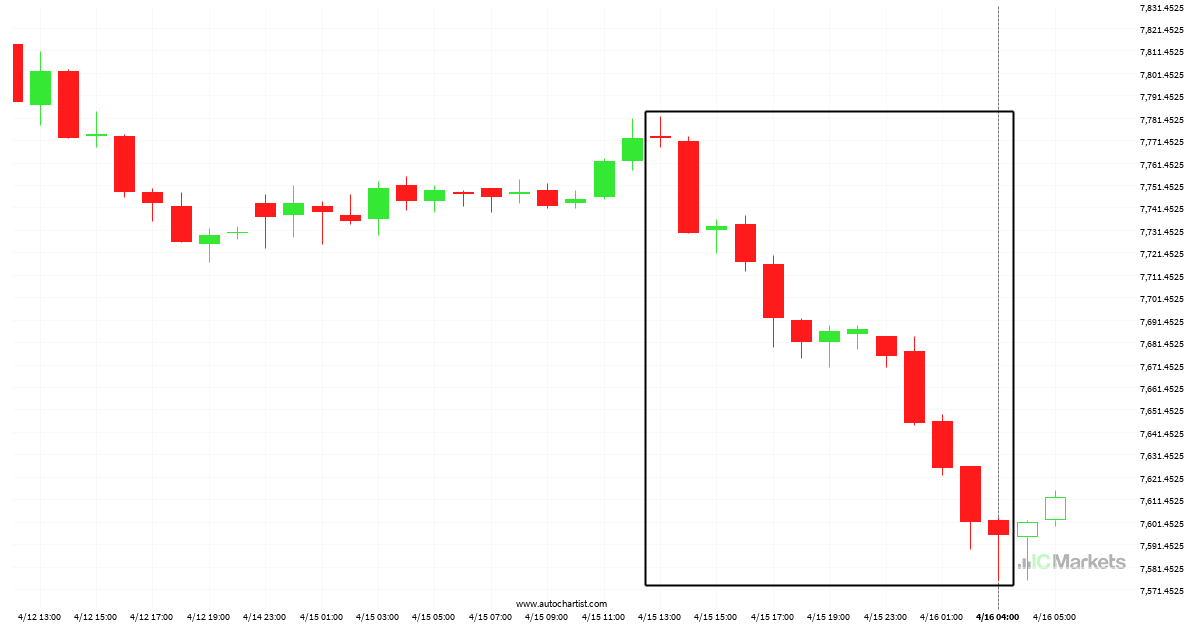

Australia 200 Index was on its way down

Australia 200 Index hits 7595.41 after a 2.28% move spanning 15 hours.

Possible breach of support level by Australia 200 Index

Emerging Falling Wedge detected on Australia 200 Index – the pattern is an emerging one and has not yet broken through resistance, but the price is expected to move up over the next few hours. The price at the time the pattern was found was 7725.3 and it is expected to move to 7698.6472.

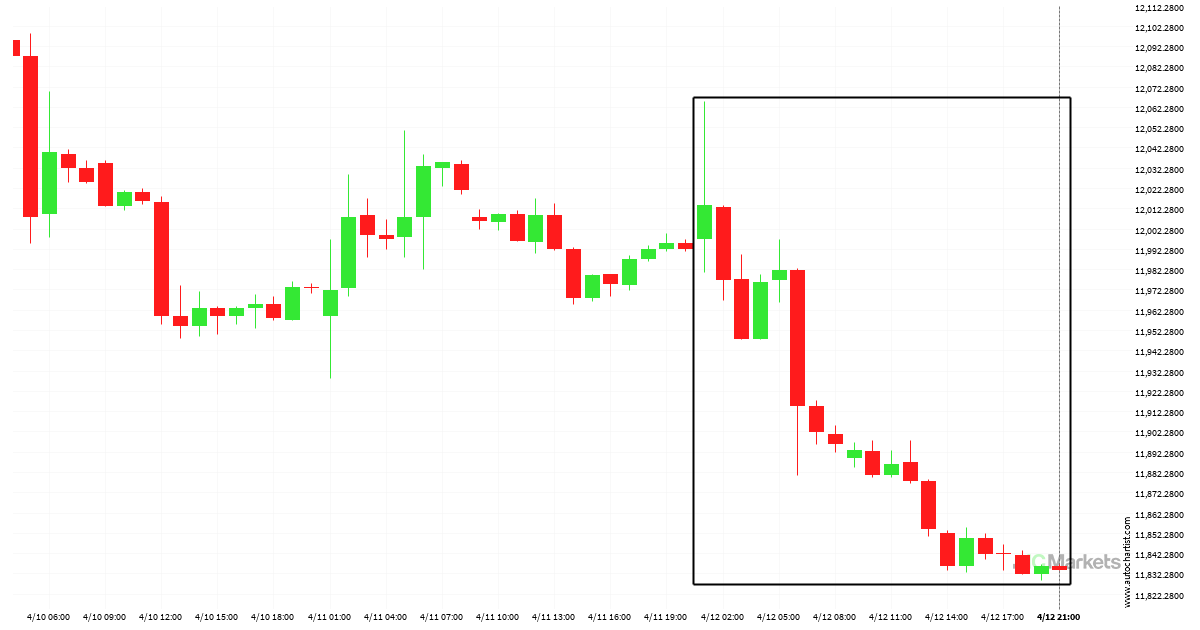

Huge movement on FTSE China A50 Index, did you miss it?

FTSE China A50 Index has experienced an exceptionally large movement lower by 1.5% from 12013.99 to 11833.99 in the last 20 hours.